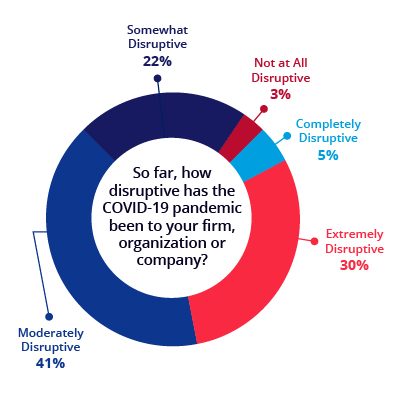

The COVID-19 sentiment survey, which closed mid-May 2020, revealed that 97% of our member respondents were experiencing various levels of disruption. As many as 30% were experiencing extreme disruption. Honestly, the staff at INCPAS was feeling it too. As we all moved our offices to our homes, communicated more frequently about ever-changing rules and deadlines, and successfully shifted seminars and conferences online, we continued to have you at the front of our mind. Your calls and emails revealed your operations were also impacted.

Instead of business as usual, you are providing clients and employers with tools and services they hadn’t imagined just 30 days earlier. And, you are doing it from different locations (with different distractions) too. This got us thinking. What are tools and services we can offer members—ones we hadn’t imagined 30 days earlier? To do this we again relied on the survey data.

This survey became a crucial tool in setting a new, more responsive course for 2020. While the survey revealed 95% of respondents[1] believe INCPAS has met or exceeded expectations during the early stages of the pandemic. It’s our goal to meet or exceed your expectations well into the future. First, we considered what had we done to deserve such a response?

- The Open Forum online community gives members access to one another to ask important questions and share valuable resources.

- Top 3 at 3, a daily, just-the-facts, need-to-know email helped quiet the noise and gave you valuable resources to share with colleagues.

- Advocates worked with state and local officials to extend deadlines, classify the CPA profession as essential and provide clarity surrounding new programs, e.g. PPP.

- Free, timely courses were added to our catalog while seminars and conferences went virtual to ensure you were able to meet your continuing education needs, while still in quarantine.

Next, What Does the Future Hold?

While there is no playbook for how to respond to COVID-19’s impact on the economy and professional lives of CPAs. We know that any sinking demand for services is likely to impact small- and medium-sized businesses at a greater rate than larger ones. In addition, some sectors such as retail, hospitality, food service, and entertainment will take longer to recover than others. It’s also possible that some pandemic habits may be here to stay. As the world sheltered in place and individuals were required to go online to perform many of the tasks previously conducted in-person, many people discovered a more efficient way to work and communicate.

Additionally, the survey highlighted the need to help our younger members learn how to maintain a healthy work/life balance. INCPAS CPA members with 6 years or less of CPA experience are more likely to be concerned with maintaining a work/life balance. We have already hosted some virtual happy hours for our Young Pros. These events give our younger CPA members a chance to relax and catch up with peers. We have several more lined up:

We are creating new opportunities for Indiana CPAs to learn from one another on hot topic issues. We have provided complimentary access to our In the Know series for members. CPA Conversations with INCPAS President & CEO Jennifer Briggs will be virtual—and free —this year as well. Focusing on current topics and live Q&A, we see these as an opportunity to deepen our connection with members. These resources developed by and for Indiana CPAs are why it’s more important than ever to have a strong relationship with INCPAS.

Finally, we know that many of our members are experiencing a reduction in resources. In order to more flexibility for maintaining your membership and participating in programs, we are offering flexible payment terms and installment payments. Now more than ever, its essential to be a member of the Indiana CPA Society.

[1] Respondents included partners, shareholders, sole practitioners, C-Suite executives, staff members, controllers, corporate accounting and finance professionals, government employees, among others.

The first in a series of benchmarking collaboratives conducted by Avenue M Group on behalf of 18 state CPA societies from across the US to analyze the impact of COVID-19 on operations. Launching at the end April and closing in early May, the full survey included over 14,000+ CPAs. In Indiana, specifically, an invitation to participate was sent to 5,822 individuals. A total of 492 surveys were collected with an overall response rate of 8%. The survey had a margin of error at +/-4% at the 95% confidence level. The industry standard for member research studies is to achieve a margin of error at +/-5% at the 95% confidence level. Thus, results are considered representative of INCPAS’ audience overall.