Executive Summary

The COVID-19 pandemic has certainly changed the landscape for Indiana’s CPAs, regardless of whether they are working in public accounting or education. To better understand the perceived impact and anticipated future impact on operations a sentiment survey was launched in April to Indiana CPA Society members. According to the nearly 500 member respondents:

- 95% believe INCPAS has met or exceeded expectations during the pandemic

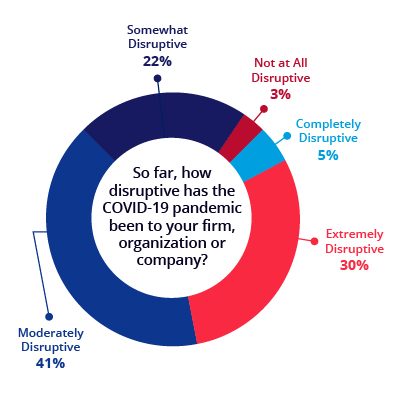

- 97% felt business had been disruptive to their organization

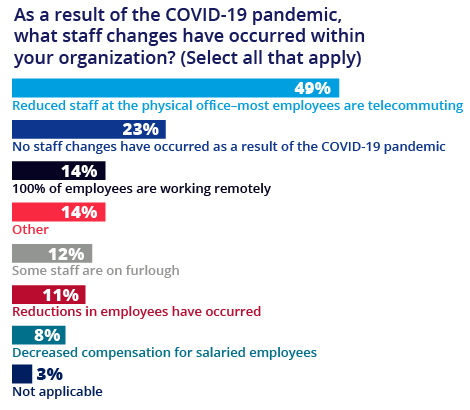

- 11% reporting a reduction in force

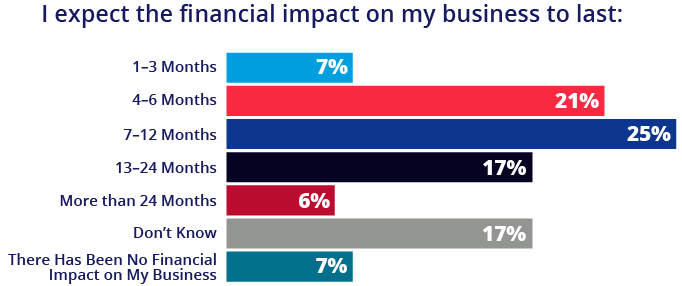

- 28% expect the financial impact to last six months; 17% stated it could be as long as 13 to 24 months

Top Challenges

The top two challenges facing most CPAs include ensuring the continued health and safety of employees and losing clients and revenue due to business closures. Keeping a work/life balance is likely to continue as many adjust to the new normal.

Employees

Employees’ health and safety are a top concern for nearly seven in ten CPAs (69%). In response numerous changes were made to members’ work environments. Fifty-one percent of INCPAS respondents reduced their staff at the physical office and 15% moved to an entirely remote workforce. Eleven percent reported staff reductions, 12% stated that some staff were furloughed, and decreased compensation for salaried employees occurred for 8% of INCPAS CPAs responding to the study.

Other actions taken by INCPAS CPAs include (verbatim responses):

Other actions taken by INCPAS CPAs include (verbatim responses):

- At risk employees are staying home

- No overtime to hourly employees

- Reduced hours

- We have gone down to a 4-day work week

- Staggered schedules

- Hiring freeze

Financial

Nearly half (49%) of INCPAS CPAs report losing revenue due to business closures. As such, it isn’t surprising that two in five respondents shared that they are reevaluating their budget and business plan to ensure long-term stability.

Other concerns expressed by CPAs include:

- Asset erosion and volatility

- Cash flow

- Suspended 401k match

Personal

The ability to maintain a work/life balance was cited as a challenge for 49% of respondents. This sentiment was significantly more prevalent among CPAs who have been working for 6 years or less and for staff members (rather than those in managerial or leadership positions).

Other concerns expressed by CPAs include:

- Some staff at home with school age children

- Staying on top of all of the changes regarding employee benefits, pay, etc.

- Having enough hours to meet client needs timely

What do you think of these results? Are they what you’re experiencing too? Is anything surprising? We’d love for you to use the comment section below to share your thoughts and experiences—how can INCPAS be of service during this challenging time?

The first in a series of benchmarking collaboratives conducted by Avenue M Group on behalf of 18 state CPA societies from across the US to analyze the impact of COVID-19 on operations. Launching at the end April and closing in early May, the full survey included over 14,000+ CPAs. In Indiana, specifically, an invitation to participate was sent to 5,822 individuals. A total of 492 surveys were collected with an overall response rate of 8%. The survey had a margin of error at +/-4% at the 95% confidence level. The industry standard for member research studies is to achieve a margin of error at +/-5% at the 95% confidence level. Thus, results are considered representative of INCPAS’ audience overall.