The emerging technologies of big data, blockchain and artificial intelligence are bringing significant changes to the CPA profession. The INCPAS In the Know webinar series is helping CPAs understand the impact of these technologies for their firms and finance departments. Two webcasts were already held on August 27 (Public Accounting focus) and September 27 (Business & Industry focus).

Insights from the Public Accounting Webinar

The public accounting webinar looked at how CPAs in public accounting need to transcend technology and focus on leveraging both emerging and current technologies to deliver superior services to their clients, as well as raise awareness of technologies already on the market to help firms increase their efficiency and profitability.

The audit section of the presentation discussed the future of audit and the changes that would be required in many firm’s audit methodologies. These changes will also require changes to firms’ training programs and increased use of computer assisted audit tools and techniques (CAATTs).

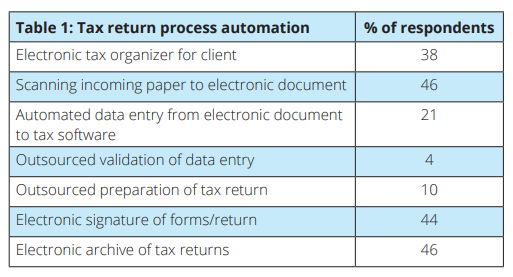

In the tax space, attendees were polled to see which tax return preparation automations or outsourcing services they were already using at their firms (see Table 1). Most predominant were the scanning of incoming documents, electronic archive of returns, and electronic signatures for tax returns, but all were still less than half of the respondents. Automations in use were also focused on the beginning and ending of the tax return preparation process, indicating there is a lot of opportunity to gain efficiencies in the automation of the actual preparation of the return.

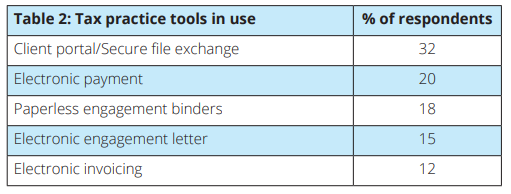

When shifting the perspective to technology supporting tax practice operations, the adoption of practice support tools was again low (Table 2). The most used tool was a client portal at 32 percent, which means less than a third of attendees are using that tool. Low responses to the use of paperless engagement binders, electronic engagement letters, and electronic invoicing indicates many practices are still very paper-heavy.

The webinar closed with a look at the impact of the emerging technologies on client accounting and the opportunity that client accounting provides accountants to really shift into a true trusted advisor for their clients.

Insights from the Business & Industry Webinar

The business and industry webinar looked at the impact of each emerging technology (big data, blockchain, and artificial intelligence) individually and had audience members share their perception of the impact of those technologies upon accountants. Before the polls were provided to attendees, I described the technology itself and then provided some examples of how the technology would change what we do as accountants.

Based on the poll results (Table 3), big data will have the most impact in the next three years with over two-thirds of attendees indicating it would have a moderate or severe impact on management accounting. Next came AI with 44 percent, and lastly blockchain with 37 percent.

The webinar continued on to look at the changes these technologies will drive in management accounting and then surveyed attendees to see which one(s) they thought would most impact management accountants (see Table 4). The increased use of data analytics and more cybersecurity requirements were the top impacts that attendees saw for the coming three years.

Want to figure out your path to innovation?

Want to figure out your path to innovation?

Would you like to figure out your path to innovation? Be sure to check out future In the Know innovation webinars to identify the changes you may need to make to your training and development plan to ensure you are able to transcend these emerging technologies. Visit

incpas.org/intheknow for 2019 dates.