It used to be that client relationships were based more on mutual trust and respect than technical knowledge. That is changing. The Hinge Research Institute found in its recent study—“Inside the Buyer’s Brain: Accounting and Financial Services Edition”—that clients want accounting and financial services (A&FS) providers who have relevant experience in their industry and extensive experience working in their line of business.

Hinge surveyed both buyers and sellers to determine what they find important in a client relationship. Here are the results of the study:

Client Disconnect

Most financial service providers believe they understand the challenges their clients face. However, data demonstrates the fallacy of that belief. Professionals in A&FS firms have significant disconnects, according to Hinge, when it comes to understanding the top challenges of their clients. As shown in Table 1, clients rank dealing with budget pressures and financial issues as their highest priority. A&FS firms ranked this category much lower (8).

According to Lee Frederiksen, Ph.D., managing partner of Hinge, “Clients want to work with professionals that have demonstrated, first-hand knowledge of solving their challenges.” A&FS firms that are not relevant and focused on the right priorities risk losing clients, regardless of the strength of their personal relationship.

Service providers who can relate to a prospect’s key challenges have more success attracting and retaining clients.

Relevancy Matters

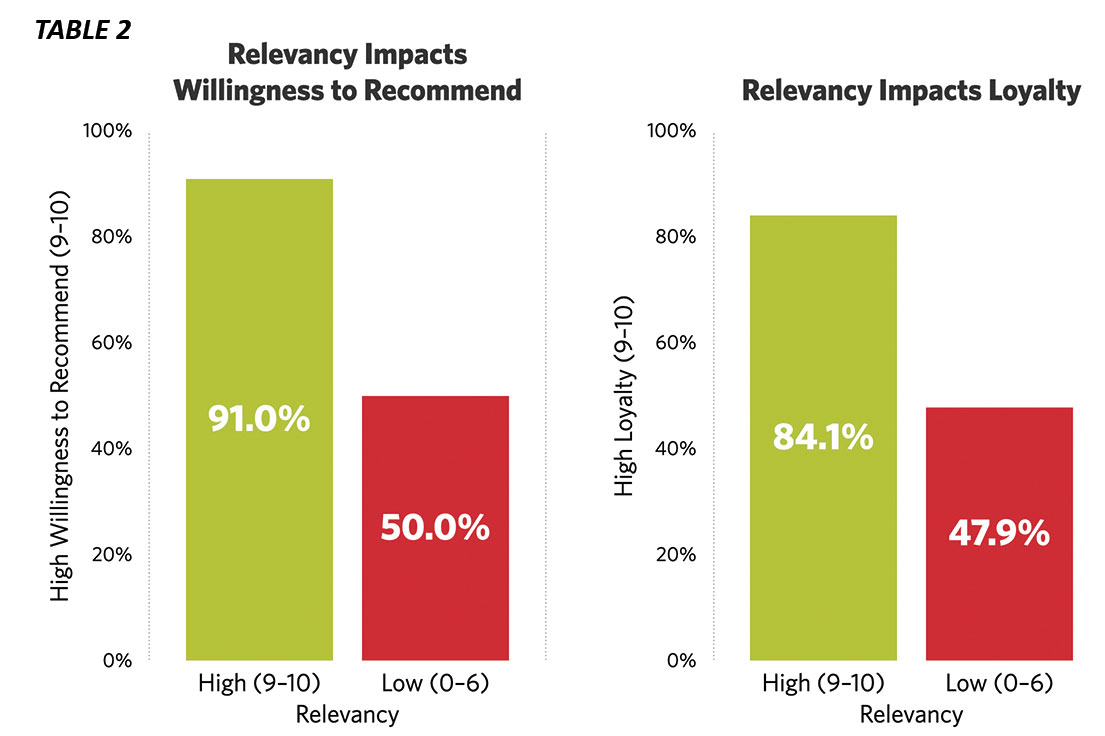

Service providers who can relate to a prospect’s key challenges have more success attracting and retaining clients. As shown in Table 2, those who are viewed as highly relevant to clients’ current issues are in fact 82 percent more likely to be highly recommended by their existing clients. High relevancy ratings are also associated with a 76-percent-higher likelihood of having highly loyal clients.

“Firms have to make it obvious that they have the relevant experience that clients need,” adds Frederiksen. “Relevancy is becoming more important than trust when it comes to client loyalty.”

Provider Search

Business owners have traditionally turned to associates when investigating business-related issues. No longer. Web searches are almost as important as asking colleagues for help.

Earning the position as a thought leader in one’s niche by writing articles, blogs and other relevant content is essential to being viewed as an expert. LinkedIn is used by more than 77 percent of organizations, making it the dominant social media platform. Facebook is making a surprisingly strong showing with a third of A&FS buyers using it for business purposes.

Evaluating Providers

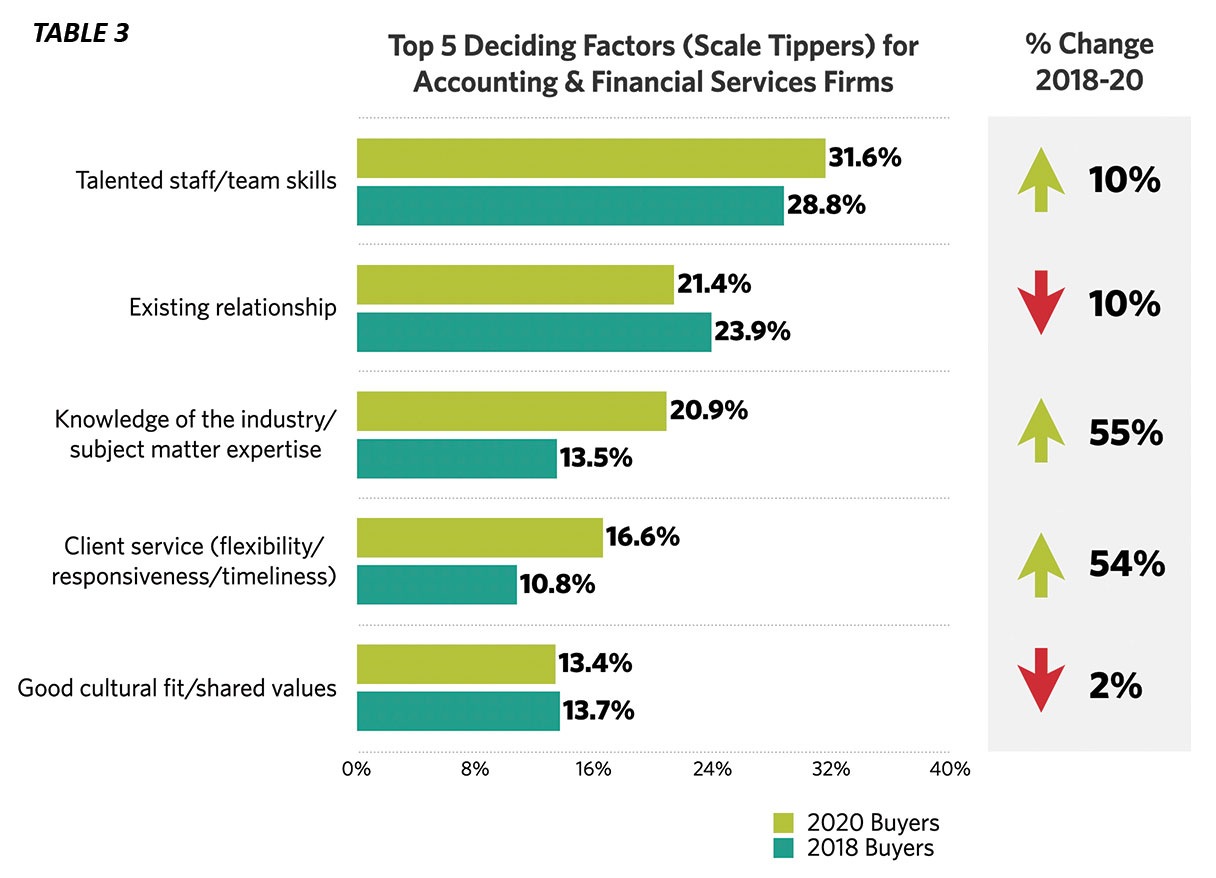

Clients are less likely to stay with an existing firm, especially if a competitor has deeper industry knowledge and a more talented staff with greater subject matter expertise. As shown in Table 3, talented staff/team skills are now the top deciding factors for almost one third of buyers. Industry knowledge and flexible, responsive client service are also becoming much more important in closing the A&FS sale.

The bottom line: Never assume clients understand what they need or how a financial services provider can help them. Make it obvious. Recruiting and retaining talented staff remains important to long-term success. Clients want to work with experts who can help them meet their challenges.

And with the widespread remote work taking place, location is becoming less important. Buyers are free to search for the expertise they need, independent of geographic location. Interactions do not need to be face-to-face to be rewarding and successful.

Reprinted with permission of the New Jersey Society of CPAs.